Mileage Rate 2025 Australia - Nike Running Shoes 2025. These were the most responsive and lively running shoes of the three. What to look for in trail running shoes. Pro athletes have sported nike running The ato has announced the latest cents per km rate for business driving: When claiming for mileage, you will want to use the rate for.

Nike Running Shoes 2025. These were the most responsive and lively running shoes of the three. What to look for in trail running shoes. Pro athletes have sported nike running

Mileage Rate 2025 Australia. The standard mileage rate is 88 cents per kilometre for 2025/2025. The ato systematically changes the cents per km rate for individuals claiming car expenses as a tax deduction.

Adobe Photoshop 2025 Free Download Windows 11. Download adobe creative cloud for free and get access to everything creative cloud has to offer, right from your desktop. Previous versions of

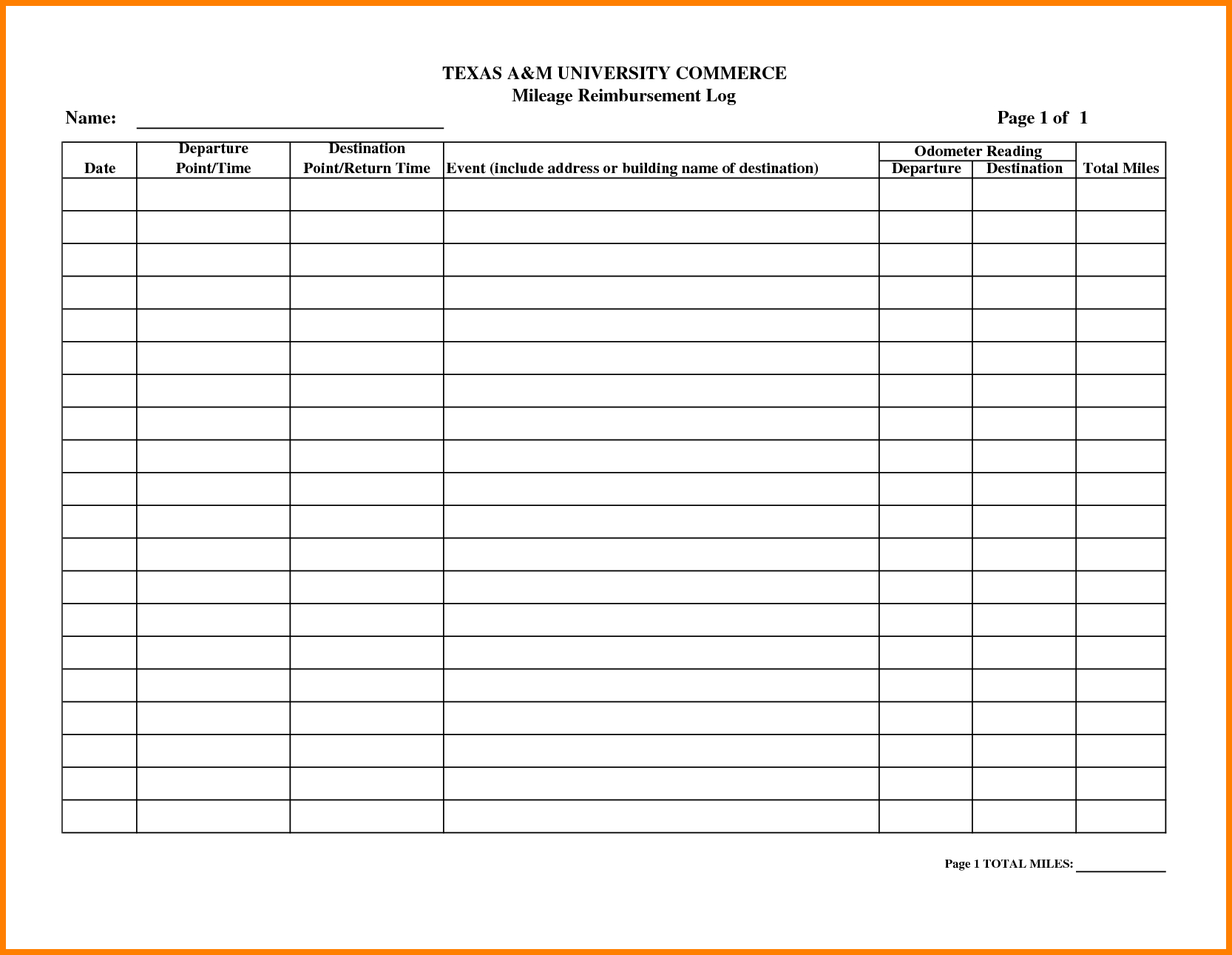

What Is The 2025 Mileage Reimbursement Rate Janey Lisbeth, The ato systematically changes the cents per km rate for individuals claiming car expenses as a tax deduction. Learn how you can apply these.

Use the simple tax calculator to work out just the tax you owe on your taxable income for the full income.

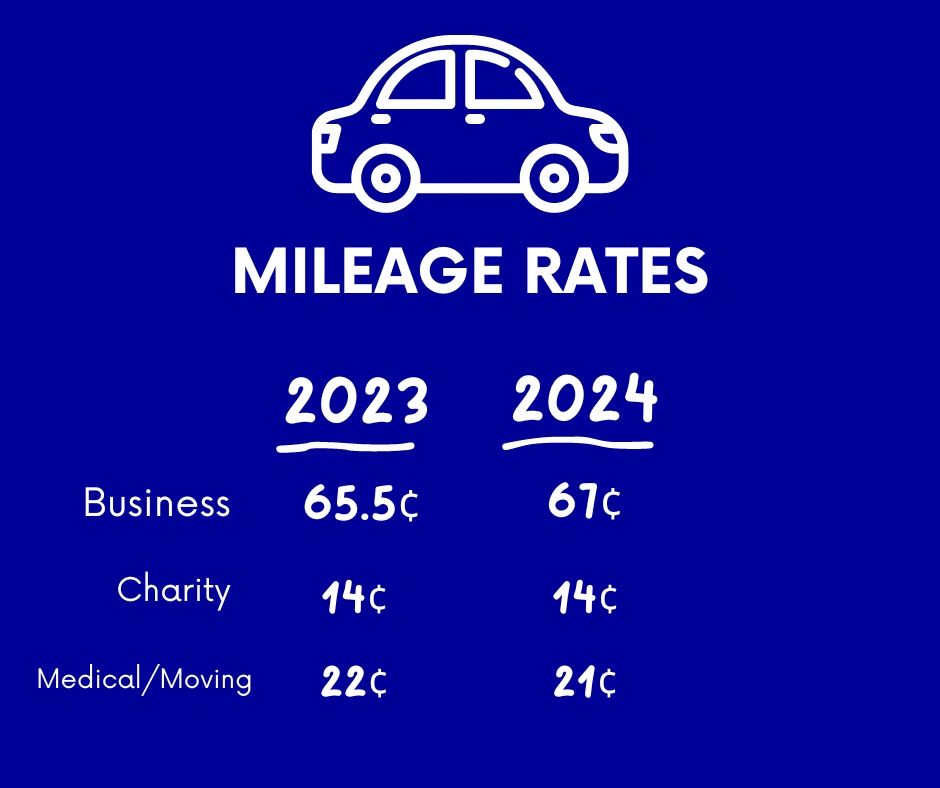

Current Gsa Mileage Rate 2025 Allyce Corrianne, The rate is meant to be used when calculating. The mileage rate includes all vehicle running expenses and depreciation, such as registration, fuel, servicing and insurance.

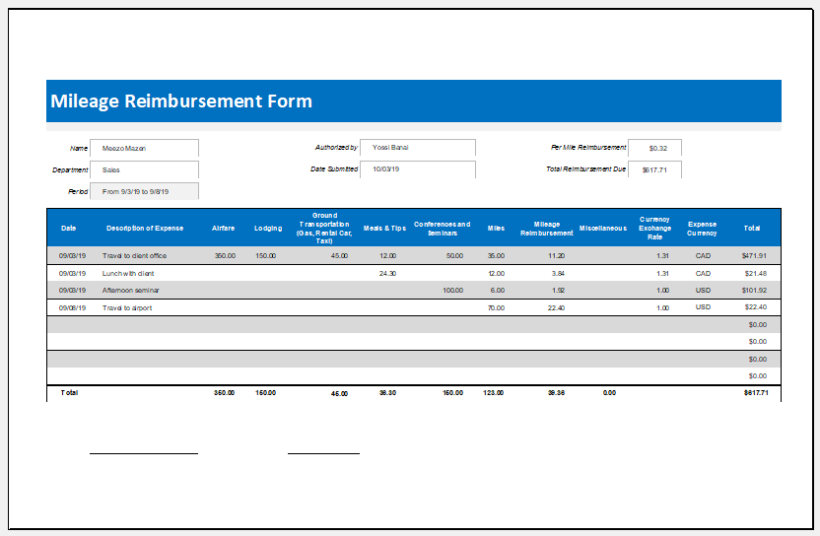

Whether you’re a finance manager trying to sort out employee reimbursements, or an employee trying to see what.

Standard mileage rates for 2025 announced; biz rate increases, Use the simple tax calculator to work out just the tax you owe on your taxable income for the full income. The mileage rate includes all vehicle running expenses and depreciation, such as registration, fuel, servicing and insurance.

2025 Standard Mileage Rates, The ato systematically changes the cents per km rate for individuals claiming car expenses as a tax deduction. The motor vehicle exempt rate is aligned with the rate determined by the federal commissioner of.

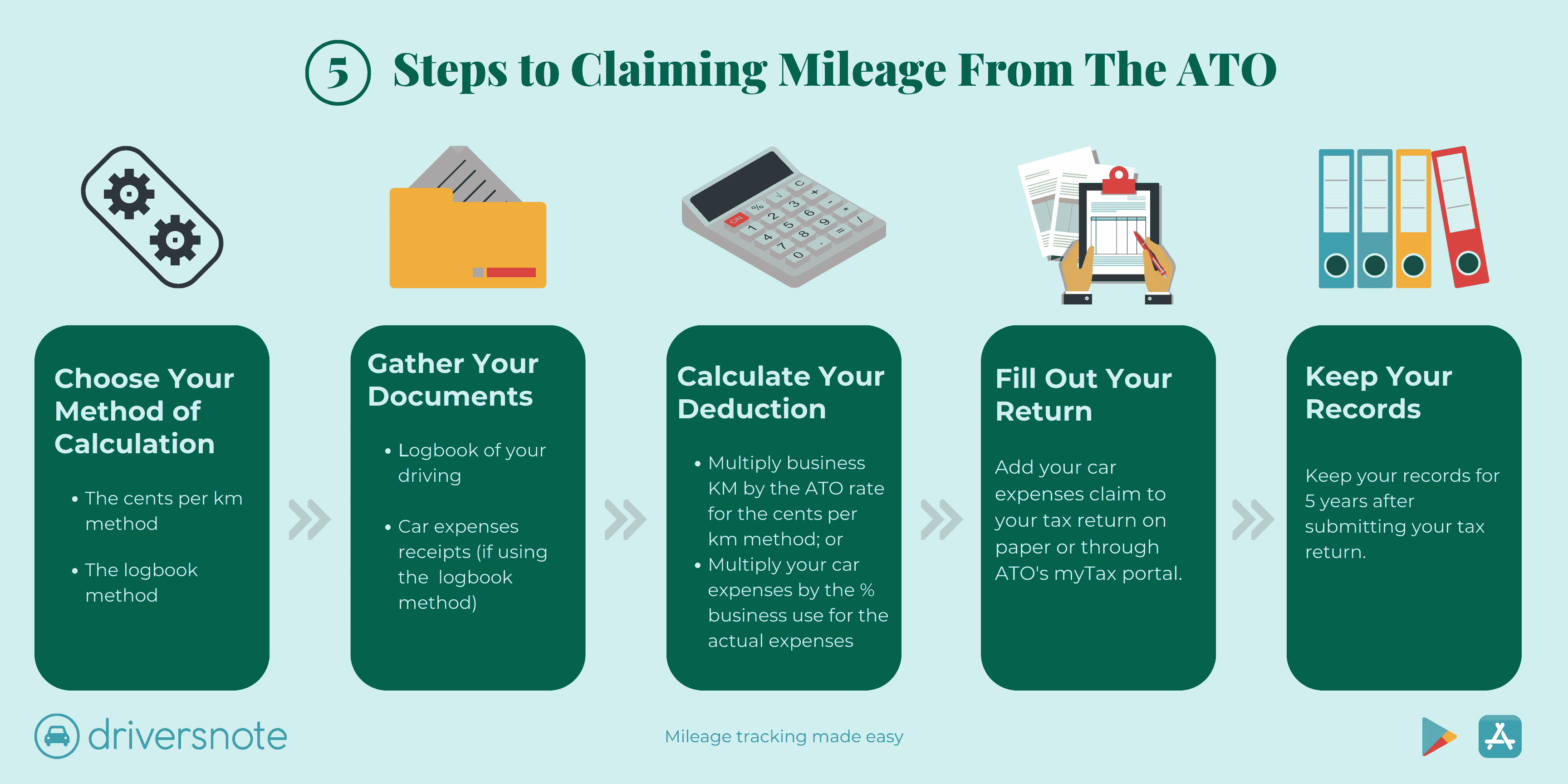

Claim Car Expenses From The ATO In 5 simple steps 2023 ATO Claims, Mileage rate is a term that refers to a monetary rate set by the tax authority for mileage reimbursement or deductions. To find your reimbursement, you multiply the number of kilometres by the rate:

The IRS has released the standard mileage rates for 2025., When reimbursing an employee for work related travel while using their private vehicle, can i split the award travel reimbursement rate of $0.95c into $0.85c non. On this page you will find the ato cents per kilometre rate for both the current and previous years.